Link.me

About

Link.me is a payment link app created to help businesses sell online without a website.

With over 100 million payments across 10,000 companies, its core audience is made up of brick-and-mortar business owners.

I was a Senior Product Designer in Link.me, where I led the product strategy and design for the mobile team. Later the product got incorporated by Stone.

Context

In 2019, Brazil started the lockdown due to Covid-19, and merchants were forced to completely suspend their physical operations. What product can we build to help small businesses survive by selling online and shift into digital?

Research

When I joined the team as their first product designer, they were stuck deciding features to match our competitors in the market. Even though this strategy has its benefits, it was not helping us to increase our activation rate and reduce our churn.

To distinguish ourselves in an already competitive and mature market, we needed user research to help us translate insights into features that address customer's behaviors and motivations.

Research Insights

We interviewed 15 customers to learn about the expectations and ideas for improvement they had about our product. We also asked customers to walk us through how they complete their management tasks and their daily frustrations.

I need different account permissions.

The business owner did not feel protected inviting employees to his company account because they would see all its balance, sales, and withdrawal money.

I need a desktop version to manage my business.

Customers needed a consolidated view and flow to manage the spreadsheets from custom tools on their computers besides Link.me.

I need to know how much taxes I paid

Customers expressed that executing payment conciliation at the end of the month was extremely hard considering Link.me didn't provide expense reports.

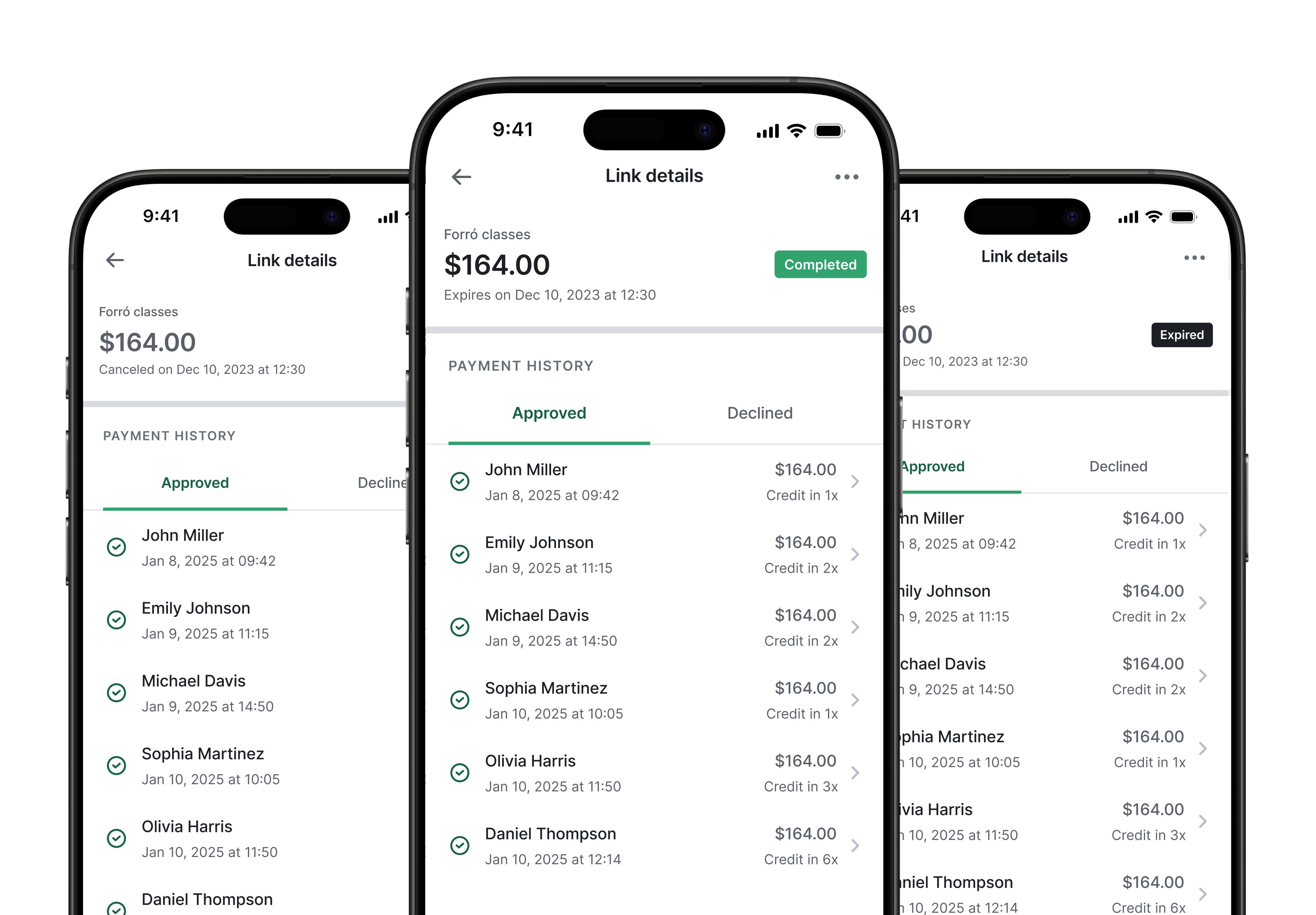

"I need a faster cash flow."

Link.me only offered two anticipation models, 30 days and 15 days. Still, it wasn't fast enough to ensure cash flow for some kinds of businesses.

In Brazil, credit card payments in installments are popular, accounting for 80% of e-commerce payments for businesses with a high transaction value. These are collected month-by-month by the merchant (ranging from two to 12 months).

Improving Link.me

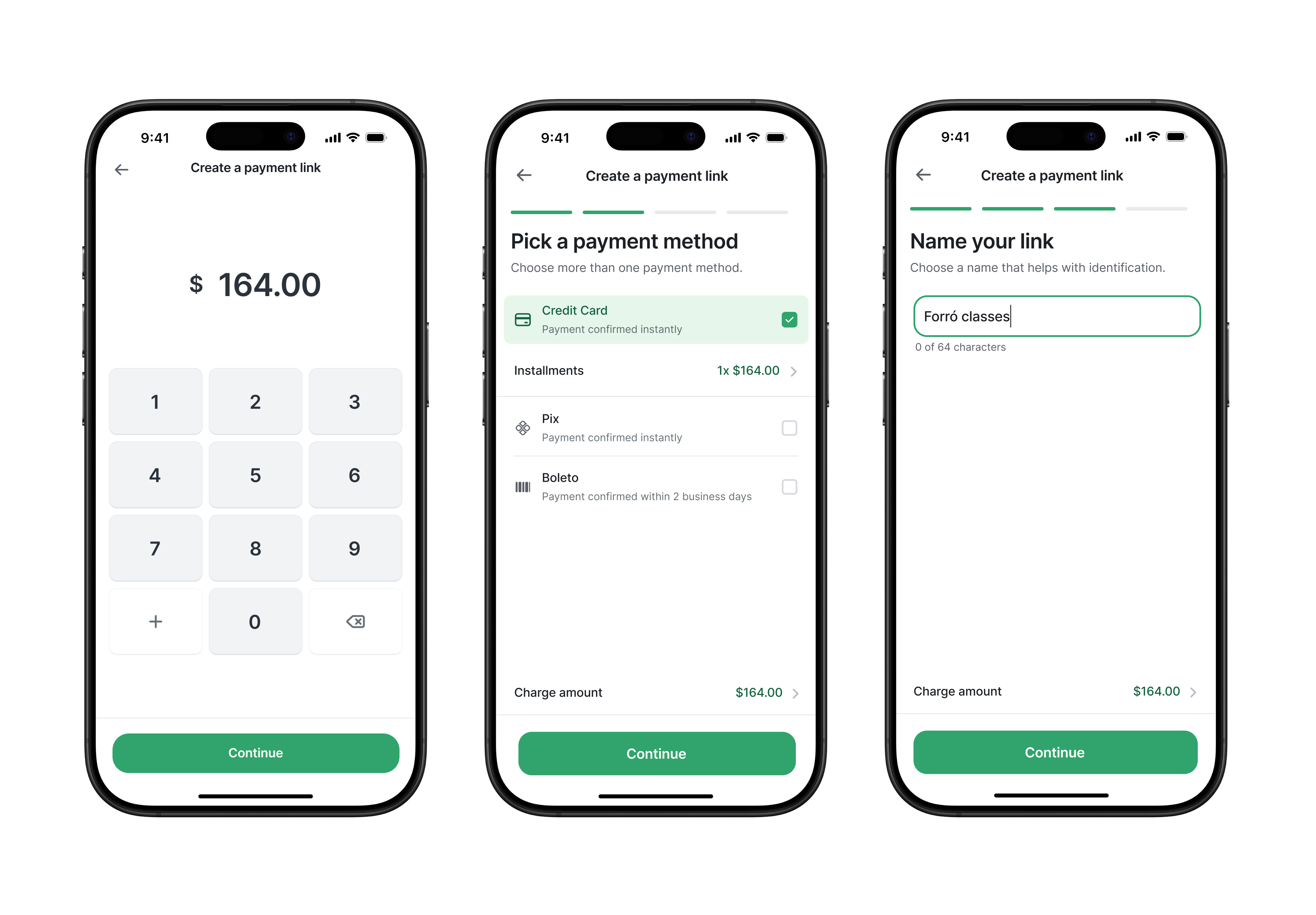

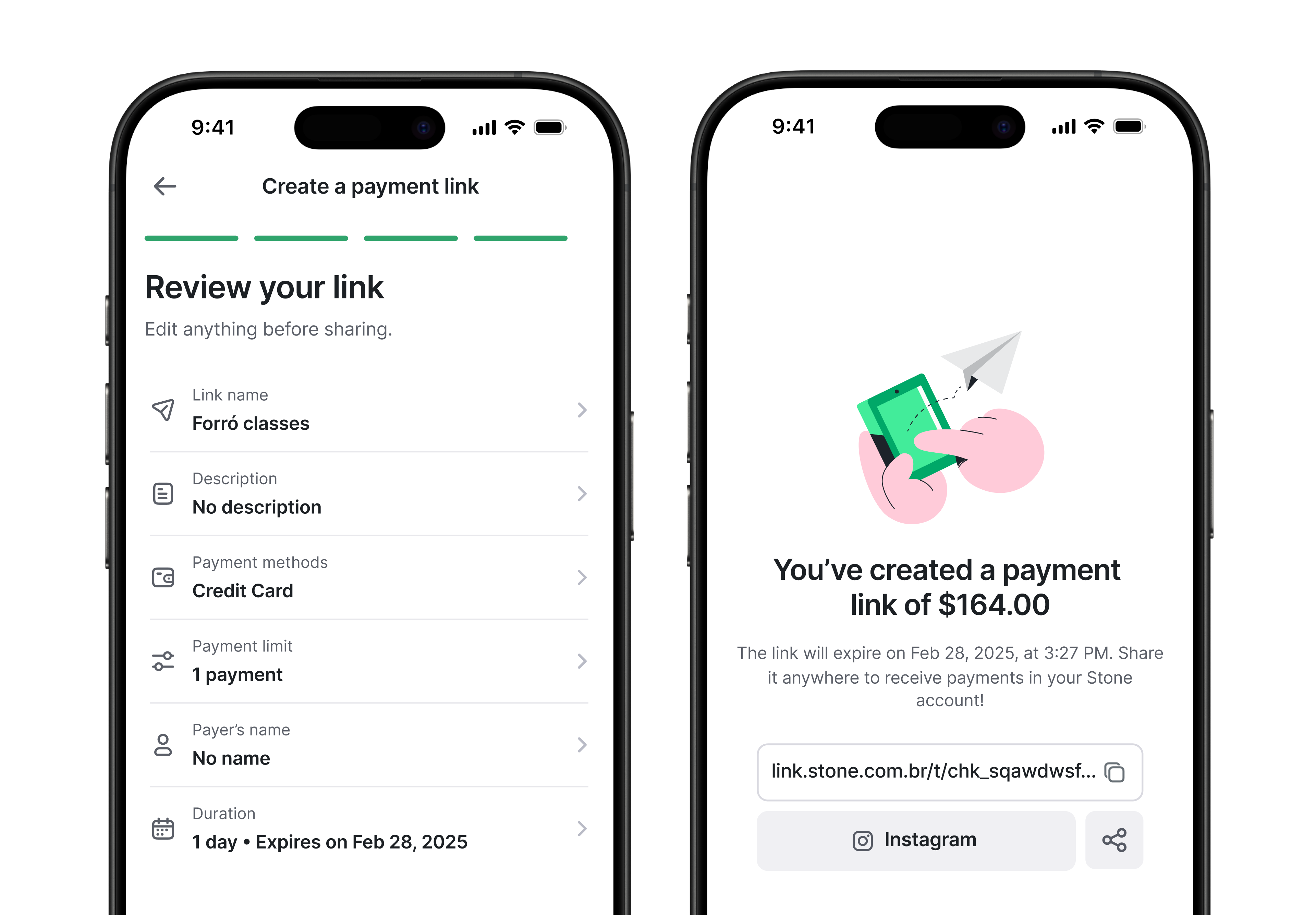

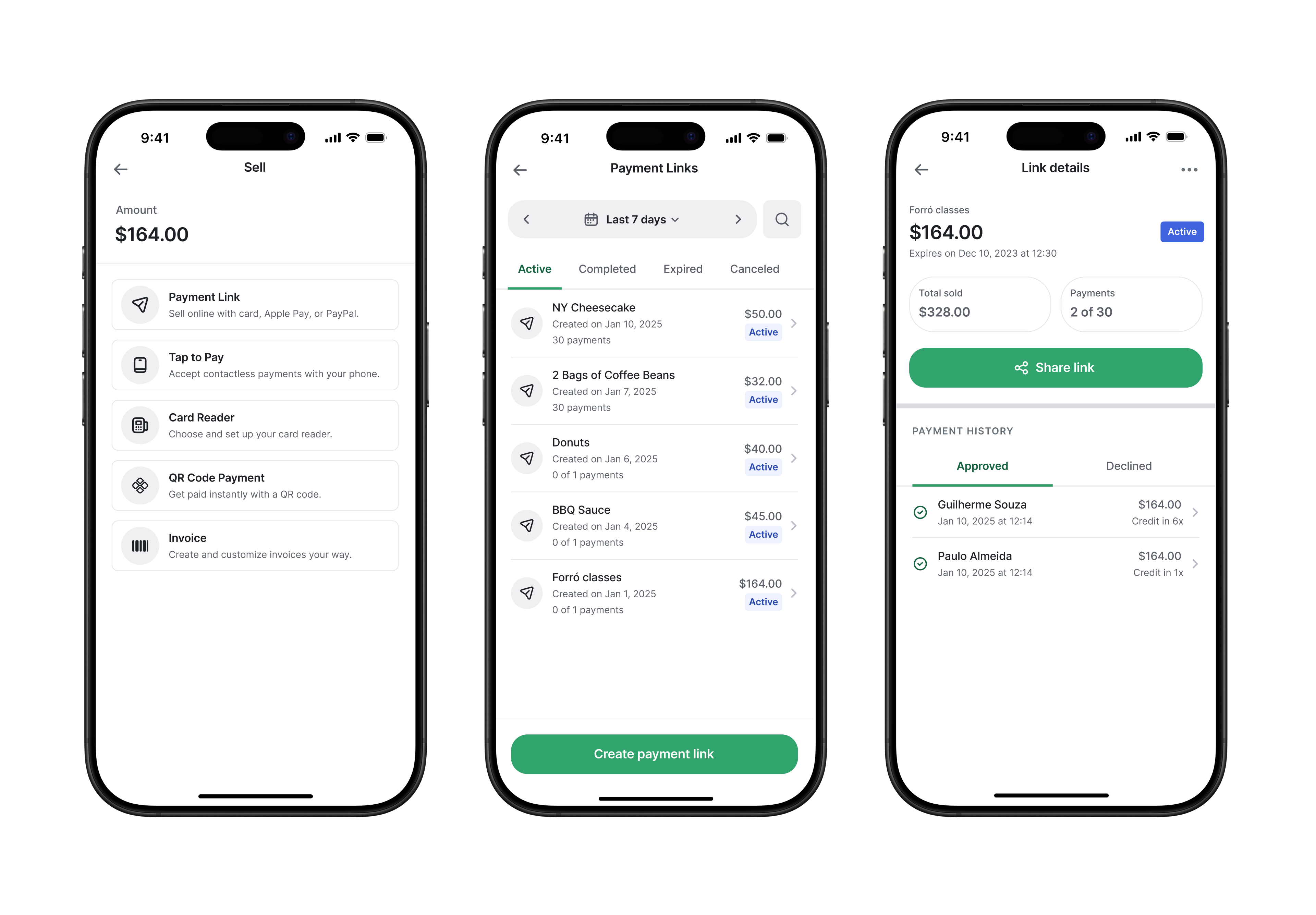

Link.me was initially created for digital companies focused on the mobile app. By 2020, tables have turned as physical businesses started to shift into digital. With the new strategy and insights, we improved Link.me to be more competitive and accessible for fast-growing companies.

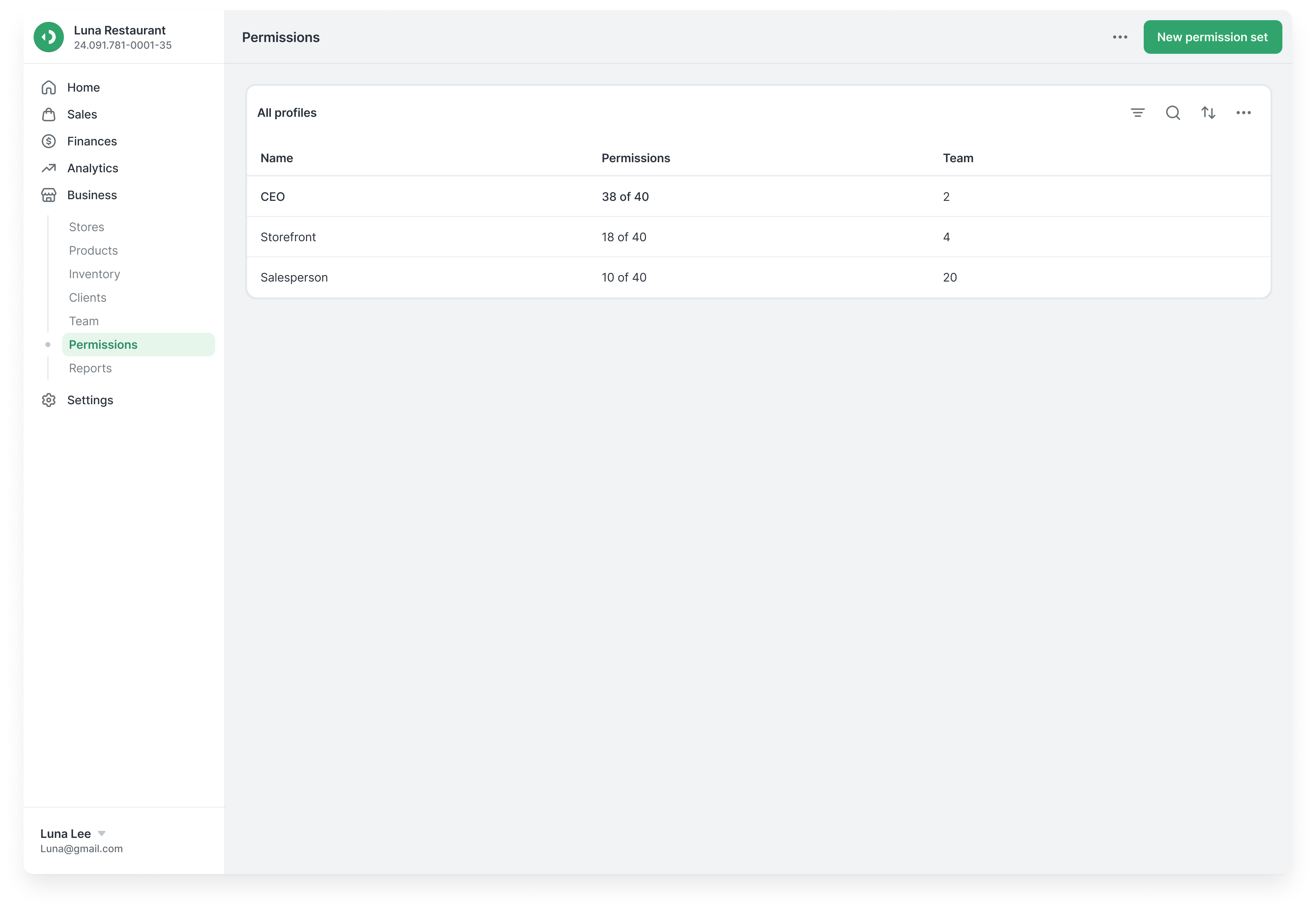

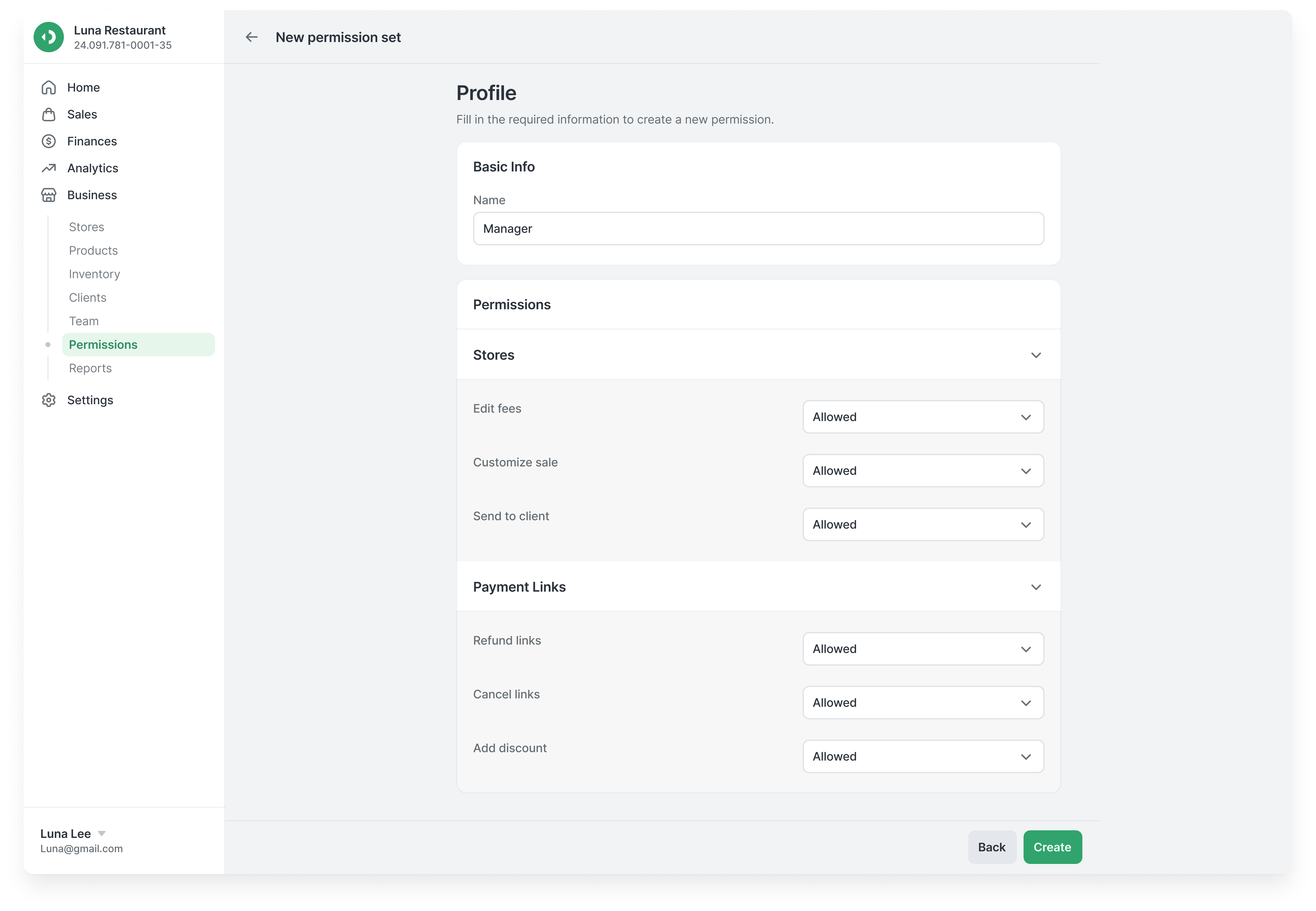

New management levels for merchants

We created the sales profile to help business owners manage their employees' access to the product by removing sensitive information and focusing on selling features.

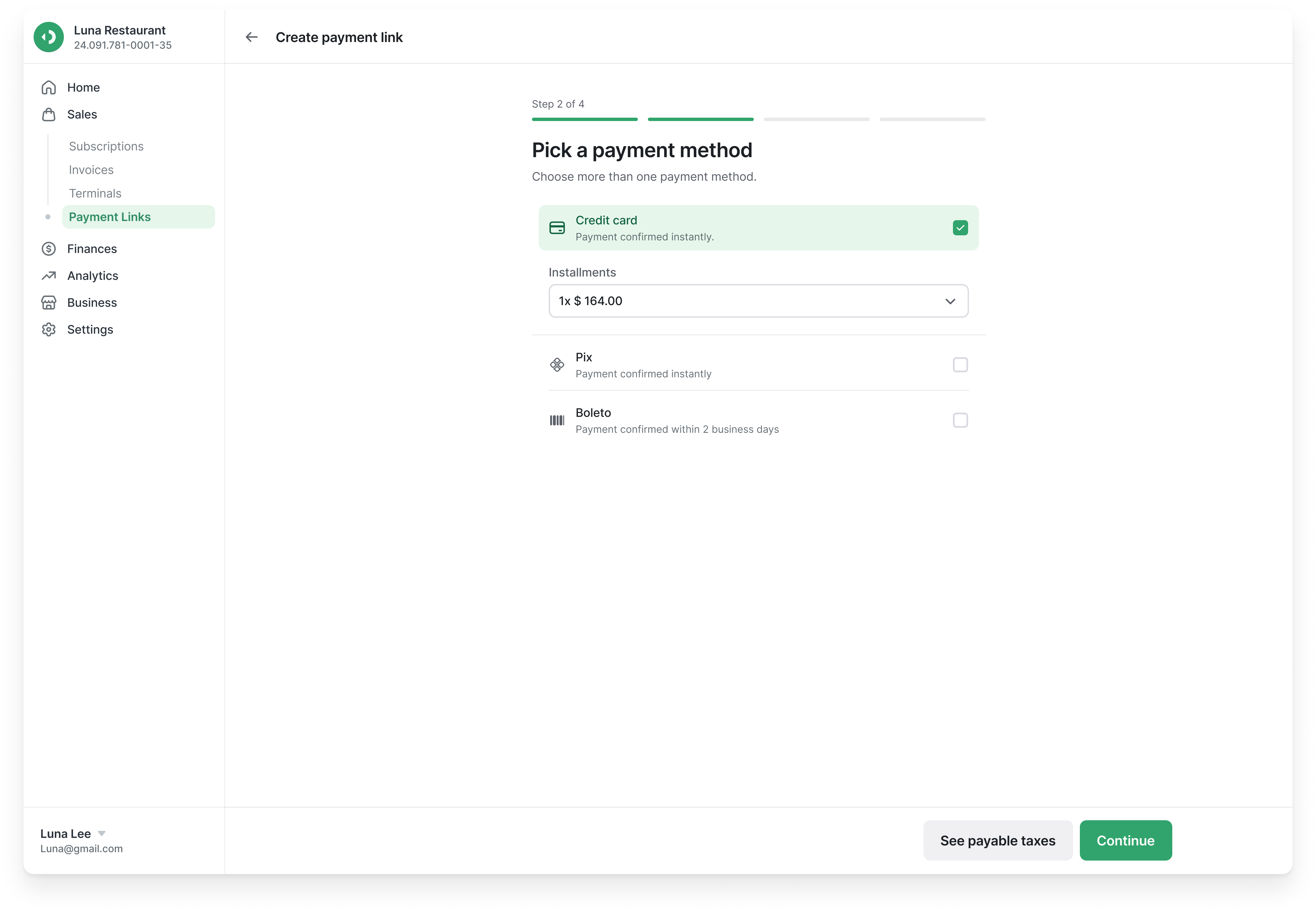

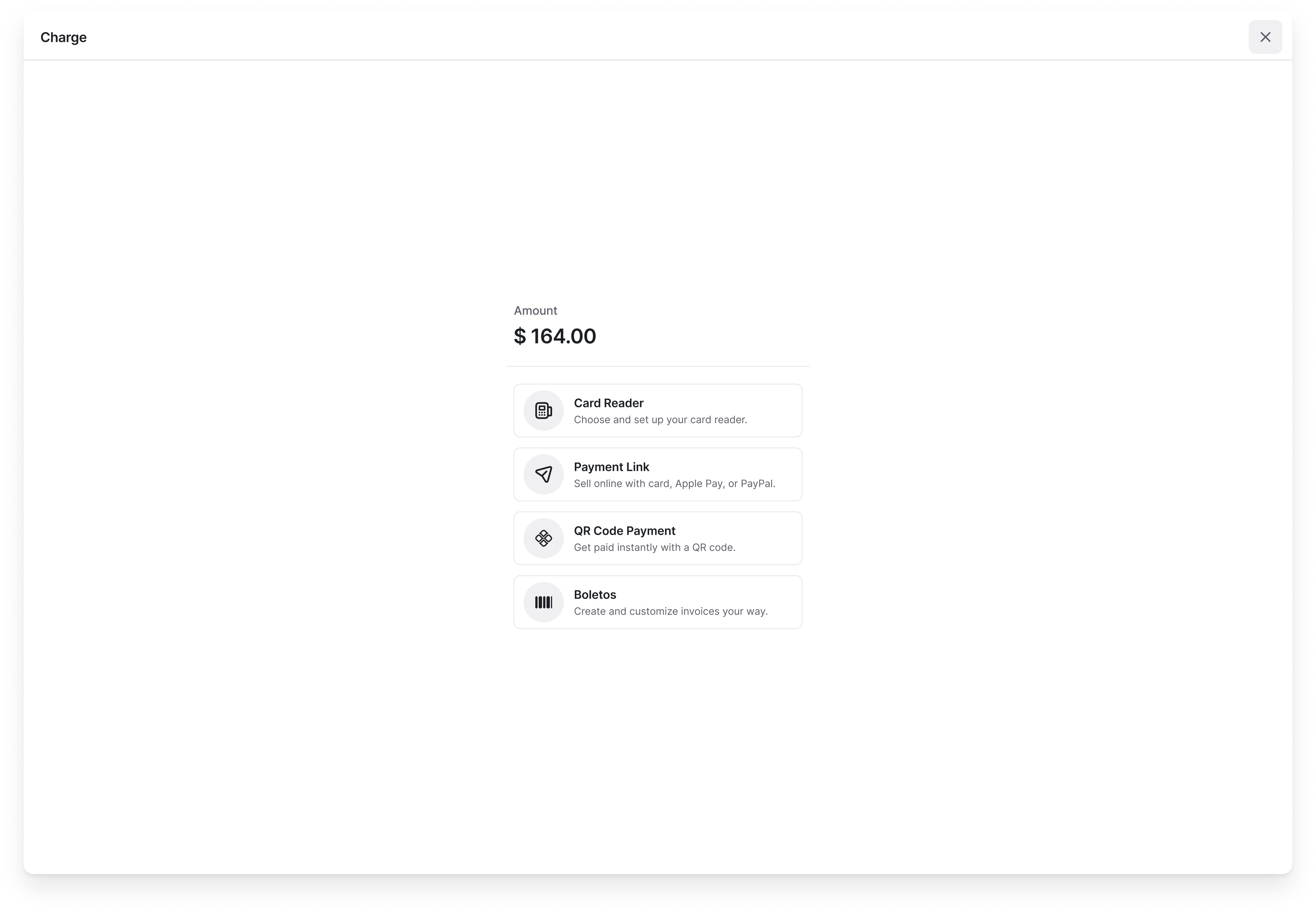

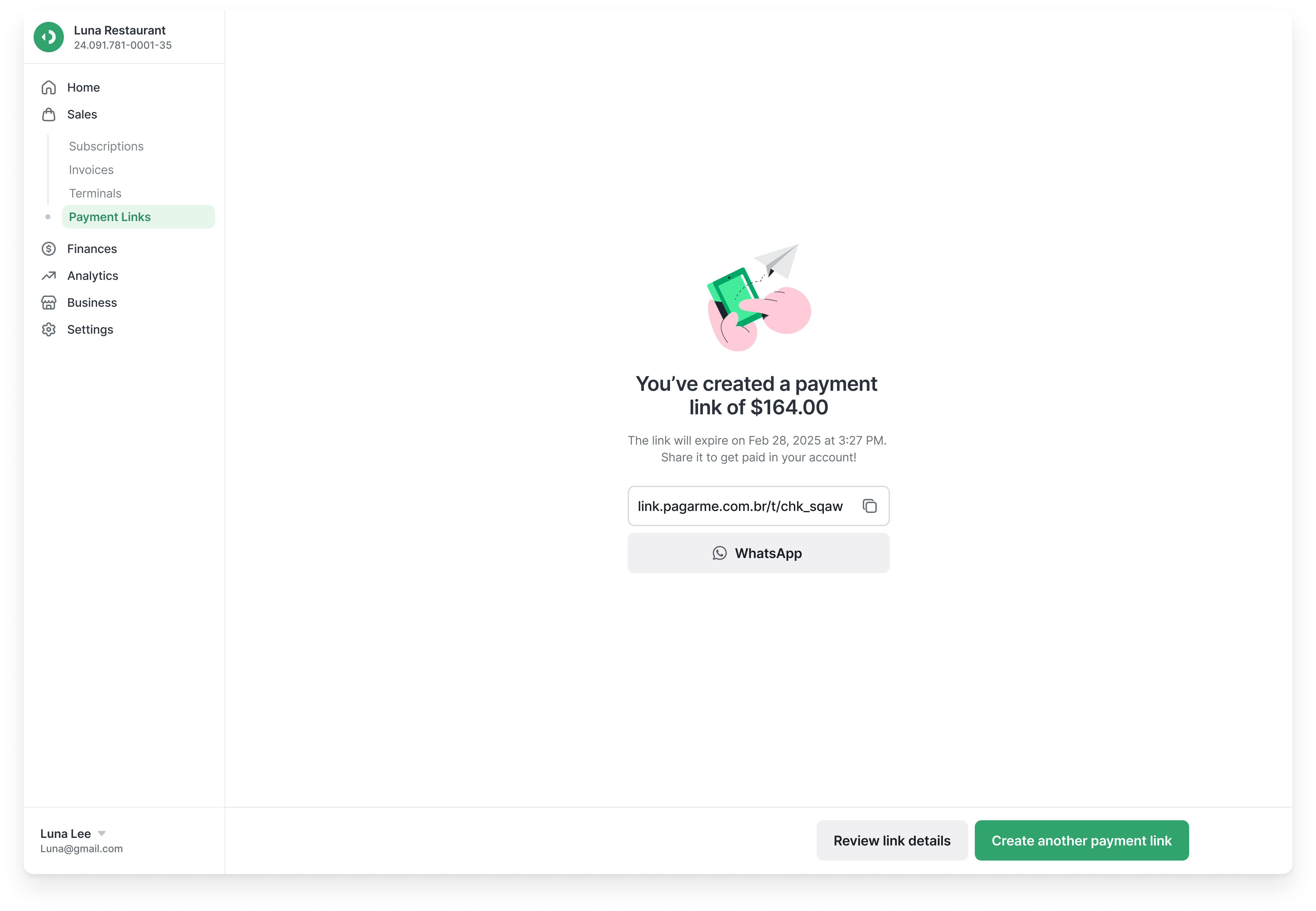

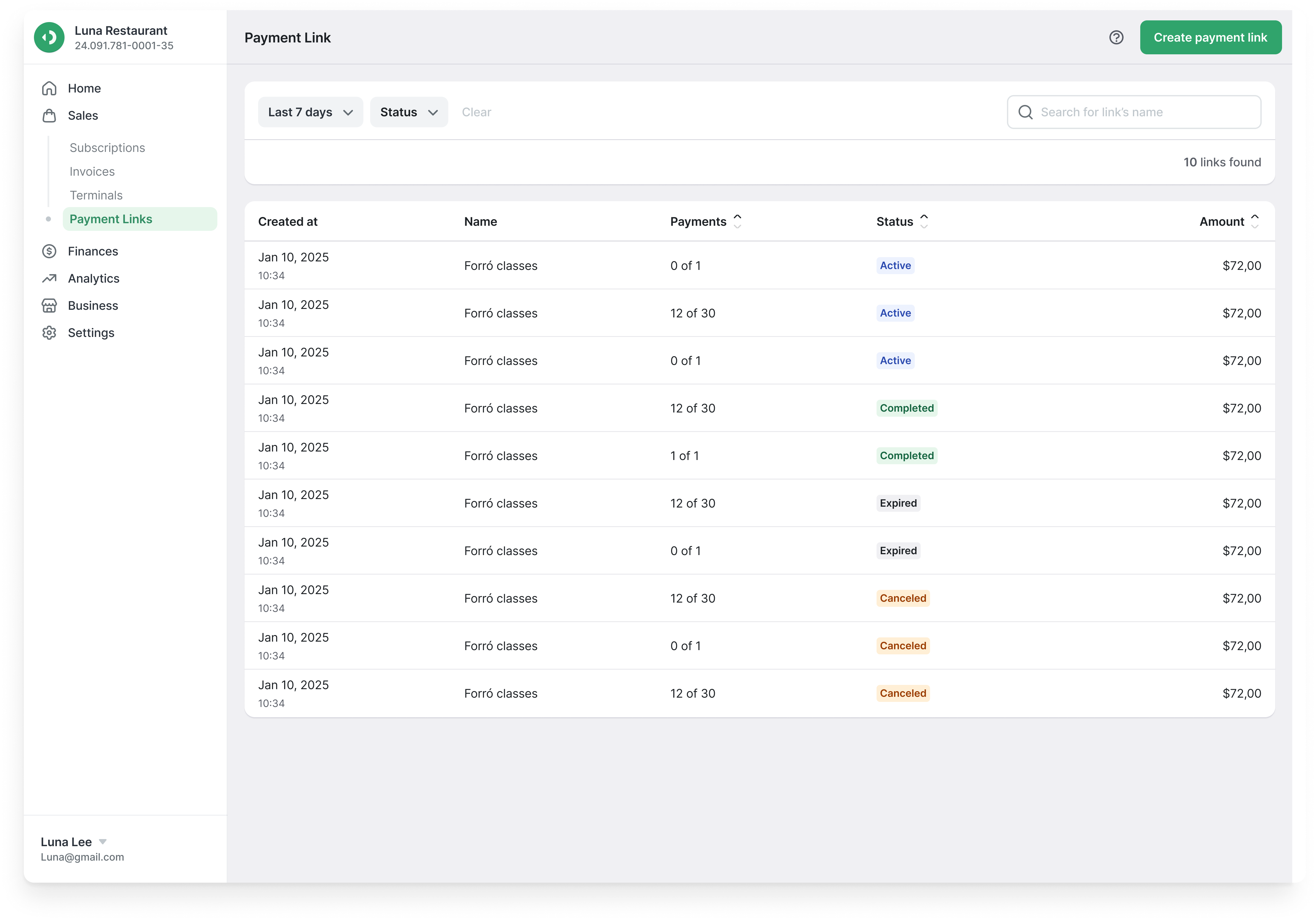

From mobile to desktop

We created personalized access for our customers to access Link.me information on the Pagar.me web platform, creating a consolidated view and flow to manage finances.